Attention: The Energy Efficient Home Improvement Credit, also known as the 25C tax credit, has expired.

If you or your customers are planning to replace an HVAC system within the next year, now is the time to act. The 25C Home Energy Efficiency Improvement Tax Credit, offering up to $2,000 annually for qualified heat pump installations and $2,600 for dual fuel systems with an eligible furnace, will be available through December 31, 2025. The latest domestic priorities bill recently passed by Congress on July 4, 2025 will terminate this credit for any systems installed after that date. We recommend that households with tax liability take advantage of this opportunity while it's still available.

Some homeowners are asking whether they should wait for the Inflation Reduction Act’s Home Energy Rebate (IRA) programs, like Minnesota’s Home Electrification and Appliance Rebate program (HEAR) to launch instead. For customers who are eligible for the 25C tax credit, the safer path is to install before the end of 2025 to lock in available savings, especially given the risk that the credit will soon be off the table.

Finally, for those considering waiting on rebates through Minnesota’s Home Efficiency and Appliance Rebate (HEAR) program and complementary Residential Heat Pump Rebate program, it’s important to understand the income requirements. Eligibility for these rebates is based on Area Median Income (AMI), and customers can use this data to estimate what, if any, support they may qualify for in the future. In the meantime, if your customers have tax liability and are ready to upgrade their heating and cooling system, now may be the most cost-effective window to act.

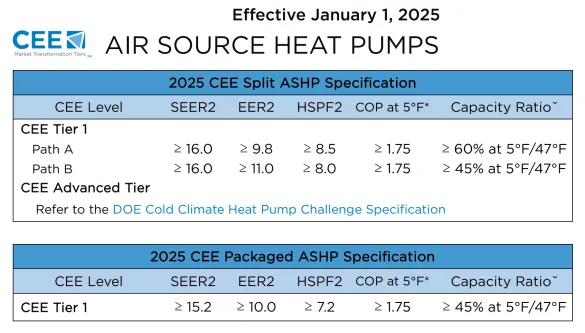

The Consortium for Energy Efficiency (CEE) has announced key updates to the Residential Electric HVAC Specifications, which will impact tax credit eligibility for heat pumps and other high-performing HVAC systems. This revision aims to simplify specifications and set a clearer standard for national market transformation, with the primary goal of making energy-efficient options more accessible and impactful across diverse climate zones and building types.

Key Objectives of the New Specifications

The updated 2025 HVAC Specifications focus on several core objectives to boost the adoption of energy-efficient systems:

1. Simplifying the specification structure: The streamlined specifications aim to increase the penetration of high-performing systems, making it easier for contractors and consumers to understand and select eligible products.

2. Supporting contractor and consumer discretion: By considering diverse climate zones, building types, and existing HVAC setups, the new specifications offer flexibility, allowing contractors and consumers to choose systems that best fit their unique needs.

3. Encouraging market transformation: The updated guidelines establish performance criteria designed to benefit both customers and the electric grid, supporting a broader push toward national market transformation.

4. Directing future demand flexibility: These specifications set a path for the industry to adapt to future demands, creating a foundation for a more resilient and responsive HVAC market.

What Does This Mean for 25C Tax Credit Eligibility?

Under the 25C tax credit program, homeowners can receive credits on qualifying energy-efficient home improvements, including high-efficiency heat pumps and central air conditioners that meet specific requirements. The CEE updates ensure that tax-credit-eligible systems align with these refined performance standards, allowing contractors to offer clients both savings on their installation and ongoing energy costs. As contractors, verifying that products meet these tax credit criteria is essential; manufacturers and distributors will provide updates on compliant units, keeping you informed about eligible product options.

Transition to the Enhanced AHRI Directory

CEE is collaborating with the Air-Conditioning, Heating, and Refrigeration Institute (AHRI) to incorporate the updated specifications into the AHRI Directory starting January 1, 2025. The current CEE Directory site will no longer be available as these listings transition to the AHRI platform, ensuring easier access to product information for contractors, distributors, and consumers alike.

Resources for Contractors

To help you adapt to these changes, the MN ASHP Collaborative remains committed to providing timely updates. We encourage contractors to review the new specifications in detail on the official CEE website, where the full 2025 and 2026 requirements are outlined. Additionally, for a summary of the current ASHP standards, refer to the latest specification summary table on the MN ASHP Collaborative website. The IRS webpage for the Energy Efficient Home Improvement Credit is also helpful for those who want to learn more about the rules and qualifications for the tax credit.

By staying informed on these specification updates and tax credit criteria, contractors can continue delivering efficient, high-performance HVAC solutions that align with national goals for energy efficiency and customer savings. For any questions or further clarification, reach out to your manufacturer or visit the Consortium for Energy Efficiency website for detailed information.